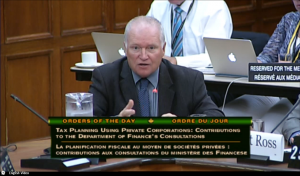

On Tuesday, September 26th, CFA President Ron Bonnett, and CFA Director of BRM and Farm Policy, Scott Ross, appeared as witnesses in the Standing Committee on Finance’s first meeting to review the proposed changes to Tax Planning Using Private Corporations. They raised concerns with the breadth of the reforms, the short consultation period during harvest, and the immediacy with which these proposals will come into force. CFA continues to advocate for a more comprehensive and deliberate process to consider potential changes to corporate taxation, which proactively engaged the business community.

However, in the absence of such a process, CFA noted the need for Finance Canada to commit to a clear process to work with the farm sector on two key fronts:

- Exempting legitimate farm income from the new Income Sprinkling rules because they cannot be applied fairly in the context of a family farm;

- Exempting qualified farm property because the new rules are detrimental to farm transfers and are inconsistent with current farm transfer tax rules.

Furthermore, a request was made to see the implementation of any new tax rules delayed until 2019, to provide businesses an opportunity to digest the changes and plan accordingly. These arguments were supported by a list of unintended consequences that CFA has noted in the proposed changes, ranging from unduly punitive tax liabilities to new barriers to succession planning.

CFA is currently receiving member feedback on a draft technical submission to Finance Canada, which will be submitted on the October 2nd deadline.

For more information on this discussion, please contact Scott Ross.